SunShine Loan Review

Exploring the realm of short-term loans can seem overwhelming, yet our thorough analysis of Sunshine is designed to offer straightforward and detailed insights to assist you in making a well-informed choice. We explore several facets of a SunShine Loan, including their loan offerings, the application procedure, interest rates, customer support, and their commitment to responsible lending practices. Our aim is to provide a balanced perspective, emphasizing both the advantages and potential areas, helping you determine if their services match your financial requirements and situation.

Sunshine specializes in short-term lending, tailoring their services to meet urgent or emergency financial needs. This focus ensures that borrowers receive assistance that is apt for their sudden financial situations, offering relief and support when most needed.

Sunshine strives to demystify this process by offering a streamlined and user-friendly experience. Customers frequently praise the straightforward application process and the quick access to funds. The company’s online platform is designed for easy navigation, making information readily available and accessible.

Eligibility Criteria for SunShine

To qualify for a loan from Sunshine , applicants must meet certain criteria. They must be over 18 years old to ensure they can legally engage in a financial contract. Additionally, they need to be residents of South Africa, which provides convenience and accessibility for both parties.

Employment status is another key requirement. Applicants should be employed and have a steady income, a common stipulation in lending that offers reassurance about the borrower’s ability to repay the loan. SunShine Loans is committed to responsible lending, ensuring that loans are given only to those who can afford them without financial strain or hardship.

How Sunshine Stands Out

Sunshine Loans distinguishes itself from other lenders with its emphasis on simplicity, speed, and accessibility. The company bypasses the need for extensive documentation and lengthy approval processes typical of many lenders, focusing instead on a quick and efficient application process. This is particularly advantageous for those in urgent financial situations where time is crucial.

Another key differentiator is their commitment to responsible lending. While their goal is to provide financial assistance, SunShine also ensures that borrowers do not end up in financially precarious situations as a result of their loans. This thoughtful approach underscores their dedication to the financial well-being of their clients, ensuring that the loans help rather than hinder the borrower’s financial status.

Choosing the right loan provider is essential for effective financial management. Whether you are seeking lower interest rates, superior customer service, or more accommodating repayment terms, our guide to the best loan providers in South Africa can help you make an informed decision.

What Sets Sunshine Apart?

Sunshine offers a range of short-term loan options designed to address immediate financial requirements effectively. The hallmark of their service is the commitment to efficiency and simplicity throughout the loan application and approval stages. Borrowers benefit from an uncomplicated online application, rapid decision-making, and swift fund disbursement, ensuring that urgent financial needs are addressed without delay.

Benefits of Choosing SunShine

When compared with other lenders, Sunshine Loans exhibits several distinct advantages. The focus on short-term loans makes them an ideal choice for those in need of quick financial solutions without the burden of long-term debt. Additionally, their transparent fee structure and commitment to responsible lending practices provide borrowers with a clear understanding of the costs involved and ensure that the loans are manageable within the borrower’s budget.

Diverse Loan Options Provided by SunShine Loans

Sunshine Loans tailors its offerings to suit a variety of short-term financial demands:

- Payday Loans: Perfect for bridging the gap between paydays, these loans offer immediate financial relief for unexpected expenses, with amounts that are manageable and terms that coincide with the borrower’s next payday.

- Emergency Loans: For urgent financial crises, like sudden medical expenses, Sunshine Loans provides emergency loans that ensure quick access to funds, thus preventing any delays during critical times.

- Cash Advances and Quick Cash Loans: These options are crafted for those who need rapid access to funds, emphasizing speed and convenience to cater to immediate financial necessities.

In every scenario, Sunshine prides itself on a straightforward and rapid online application process, aimed at making the borrowing experience as seamless and efficient as possible.

Applying for a Loan with SunShine Loans

To streamline the loan application process with Sunshine, it is crucial to have all necessary documents readily available. Generally, the documentation required includes proof of identity, proof of income, and recent bank statements. These documents allow Sunshine Loans to evaluate your repayment capability and to tailor the loan amount and terms to fit your financial situation.

How to Apply for a Loan at Sunshine

Step 1: Visit the Official Website

Begin by going to the official SunShine Loans website. Here, you can explore detailed information about their various loan offerings and start the application process.

Step 2: Select Your Loan

Browse through the different loan types SunShine provides and choose one that fits your financial needs. Whether it’s a payday loan, emergency loan, cash advance, or another form of short-term financing, select the option that best suits your situation.

Step 3: Complete the Online Application

After choosing your loan type, you will need to complete the online application form. It’s important to enter all requested personal and financial information accurately, including your name, contact details, employment status, income level, and any other necessary details.

Step 4: Upload Required Documents

Gather and prepare essential documents such as your proof of identity, proof of income, and recent bank statements. Upload these documents securely through the online portal to support your application. Accurate and current documents are crucial for a quicker application review.

Step 5: Review and Submit Your Application

Take a moment to review your application to ensure all the information is correct and complete. An accurate application helps facilitate a smoother approval process.

Step 6: Await Approval

SunShine Loans is known for their quick processing times. Stay in touch with any updates from them as they may reach out if further information is needed or to provide you with the status of your application.

Step 7: Receive Your Funds

Following approval, the loan funds will be deposited directly into your bank account, typically on the same day. Keep an eye on your account to see when the funds arrive so you can manage them according to your needs.

Eligibility Pre-Check

Before formally applying, utilize Sunshine online eligibility checker. This feature allows you to enter basic information such as your income and desired loan amount to preliminarily assess your eligibility. This step can help you estimate your likelihood of obtaining a loan before you proceed with the full application.

Security and Privacy at SunShine Loans

Sunshine places a high priority on the security and privacy of your personal and financial details. They use advanced encryption technology to safeguard data as it is transmitted through their website. Furthermore, they have comprehensive privacy policies that clearly define how customer data is collected, utilized, and protected. SunShine Loans is committed to building trust with their clients by maintaining transparency about their data management practices, providing a secure and dependable service.

For more detailed information on the application process, eligibility criteria, and loan terms, make sure to review the specific terms and conditions provided by Sunshine.

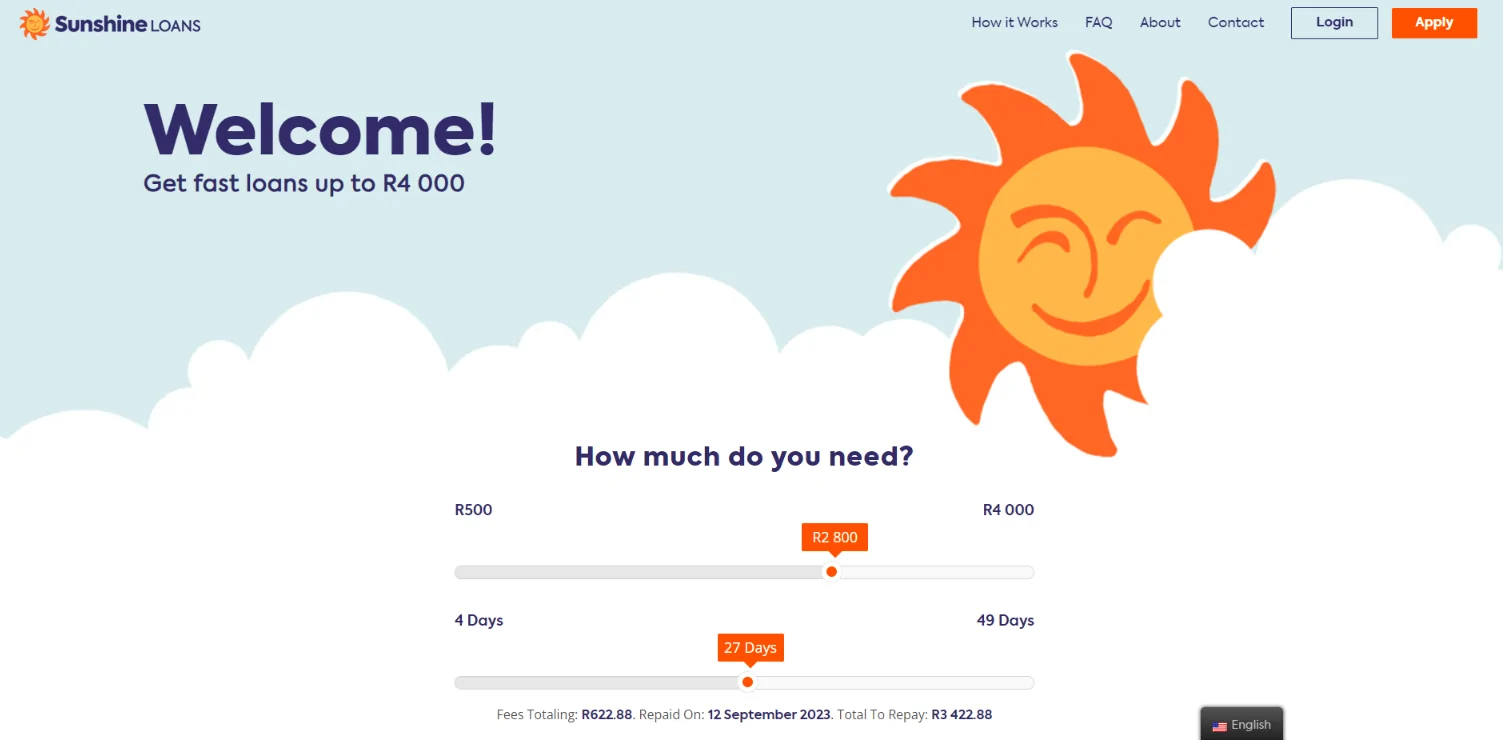

Loan Amounts Available from Sunshine Loans

The amount you can borrow from SunShine Loans varies depending on the loan type and your individual financial circumstances. Generally, loan amounts start at R500 and can go up to R4,000. Each application is assessed on a case-by-case basis, with considerations like your income level and repayment capacity influencing the determination of the most appropriate loan amount and terms.

SunShine also offers personalized loan solutions, adapting terms to accommodate the unique needs and financial situation of each borrower. This tailored approach helps ensure that loan offers are compatible with the borrower’s repayment abilities, fostering responsible lending and borrowing practices.

Loan Disbursement Speed

A key advantage of Sunshine Loans is their efficiency in processing applications and disbursing funds. Typically, the approval process is completed within one business day. Once approved, funds are usually transferred to the borrower’s bank account quickly, addressing urgent financial needs swiftly. The exact timing of fund receipt may vary depending on factors like the applicant’s bank and when the application is submitted.

Loan Repayment Information

Repaying a loan from SunShine is streamlined to align with the borrower’s pay cycle. Repayment amounts are automatically debited from the borrower’s bank account, simplifying the process and minimizing the likelihood of missed payments.

It’s also important to be aware of any potential fees and penalties associated with your loan. Although Sunshine Loans is committed to transparent fee structures, it is advisable for borrowers to fully understand all potential additional costs, such as late payment fees, to prevent any unexpected charges during the repayment phase.

Online Reviews of Sunshine Loans

Online reviews are a crucial resource when evaluating lenders like Sunshine. These reviews provide insights from past and current customers, shedding light on the lender’s reliability, customer service quality, and the overall experience with their loan offerings. While individual experiences can vary, these reviews frequently reveal common patterns and areas where the lender both shines and may need improvement.

To get a well-rounded view of SunShine Loans, it’s advisable to consult several review platforms. This approach helps understand the general consensus on key aspects like the simplicity of the application process, speed of fund disbursement, clarity of loan terms, and the effectiveness of customer support.

Customer Service at Sunshine Loans

Sunshine is committed to providing thorough support throughout the loan process. They offer multiple communication channels for customers who need further information or assistance. Whether you have questions or need help during the application process, their customer service team is ready to provide necessary guidance and support.

Accessible and responsive customer service is essential, ensuring that all borrowers feel supported and well-informed from the beginning to the end of their loan journey. If you encounter any doubts or questions, SunShine Loans’ customer support is readily available to help you move forward with your loan application and repayment with assurance and clarity.

Pros and Cons of SunShine Loans

Pros:

- Quick Approval and Disbursement: Sunshine Loans is known for its swift approval process, often releasing funds within one business day.

- Online Convenience: The entire loan process, from application to approval, can be handled online, offering significant convenience.

- Transparent Fees: The fee structure at SunShine is clear, helping borrowers to understand all associated costs fully.

- Personalized Loan Offers: Loans are customized according to individual financial situations, promoting responsible borrowing.

Cons:

- Limited Loan Amounts: With a maximum loan cap of R4,000, some borrowers may find the amounts insufficient for their needs.

- Short Repayment Terms: Focusing on short-term loans often means shorter repayment periods, which may not be ideal for all borrowers.

- Accessibility Issues: Being primarily an online platform, individuals without internet access or those who are less tech-savvy might struggle to use their services.